Cost saving is not just about saving a few dollars in the bank. This is your mindset and goal of saving money that helps you, whether you are looking to get out of the check cycle to pay, your emergency fund or you want to learn how to be financially more successful Be the right book can be your roadmap for success. But how do you choose from many of the options there? Don’t be afraid! In this article, we will read the books you need to read about savings that allow you to gain control of your finances and bring you to travel to financial freedom.

Understanding the Importance of Saving Money

Cost savings are not just a few dollars. This is a safety network for itself and your future. Why save? Think of this as seed planting for your financial garden. The sooner you plant those seeds, the more your money will grow. And let’s not forget that compound interest is interesting because it only earns money. In due time, those small savings in a very significant egg flourish.

“The Total Money Makeover” by Dave Ramsey

In a world where financial stress is a common burden that most people share, it is refreshing to find Dave Ramsey’s “The Total Money Makeover” to be quite transformational as far as personal finance is concerned. First printed in 2003, this book has become the cornerstone of financial education for millions on how to get out of debt, build a solid savings foundation, and amass long-term wealth. Ramsey’s philosophy isn’t all about the numbers; rather, it conveys a paradigm shift in one’s thinking toward enduring financial security.

Lying at the heart of “The Total Money Makeover” is Ramsey’s “Baby Steps,” an ordered plan that leads one through financial transformation. The Baby Steps are designed to be simple yet powerful, addressing psychological and practical features of money management.

“Your Money or Your Life” by Vicki Robin and Joe Dominguez

Originally published in 1992, “Your Money or Your Life” remains influential for many people in reconfiguring their financial lives. What it comes down to is the central question: What is your life energy worth? The authors lead readers to consider the most valuable time as their time and to reconsider the fit of money into the context of a fulfilling life. It’s not only about financial independence; it’s about a meaningful life, which sounds very impressive in today’s fast-paced and often stressful world.

One of the most resounding concepts that Robin and Dominguez developed is the notion of “life energy.” They uphold that every hour one works to make money represents a part of their life. The concept shifts the narrative from merely earning and spending money to understanding the true cost of our choices in time and energy. For example, if you earn $20 an hour and spend $50 on dinner, what you’re doing is not spending money but losing 2.5 hours of your life paying for that meal. This realization may well serve as a powerful encouragement toward conscious spending.

“The Simple Path to Wealth” by JL Collins

The Simple Path to Wealth” is a 2016 publication that summarizes several years of investment experience into easy-to-understand advice that equally appeals to inexperienced and professional investors alike. Collins originally wrote this book as a compilation of letters to his daughter on financial wisdom that he wished someone had shared with him earlier in life. Through its allрід directness and working tips, the book has drawn tremendous followership and has become one of the foundational books of contemporary personal finance literature.

The cornerstone of Collins’s philosophy rests on the importance of saving as the means to financial independence. He points out that the first step to wealth is not how much you make, but how much you can save from what you make. Collins recommends a savings rate of a minimum of 50% and encourages the reader to reassess and cut unnecessary expenses often in order to maximize their ability to save.

“I Will Teach You to Be Rich” by Ramit Sethi

At the heart of Sethi’s philosophy is a shift in mindset. He encourages readers to redefine what being “rich” truly means. Rather than fixating solely on accumulating wealth, Sethi emphasizes living a life aligned with personal values and goals. According to him, being rich is not just about having a large bank balance it’s about having the freedom to pursue passions without financial constraints. This view is supported by research; for instance, a study conducted and published in the Journal of Personality and Social Psychology found that financial well-being was more related to individual satisfaction and experiences than just monetary wealth. (Dunn & Norton, 2013).

Probably, one of the most critical works of Sethi dealing with personal finance is his advocacy for automating finance. He believes that automation of investments, savings, and bill payments takes the emotion and hassle out of managing money. For instance, setting up automatic transfers to savings accounts can help individuals save without even thinking about it, enabling consistency and discipline in financial habits. Sethi’s recommendation of using tools like high-yield savings accounts and investment platforms aligns with findings from the National Bureau of Economic Research, which suggests that individuals are more likely to achieve savings goals when processes are automated (Bucks et al., 2009).

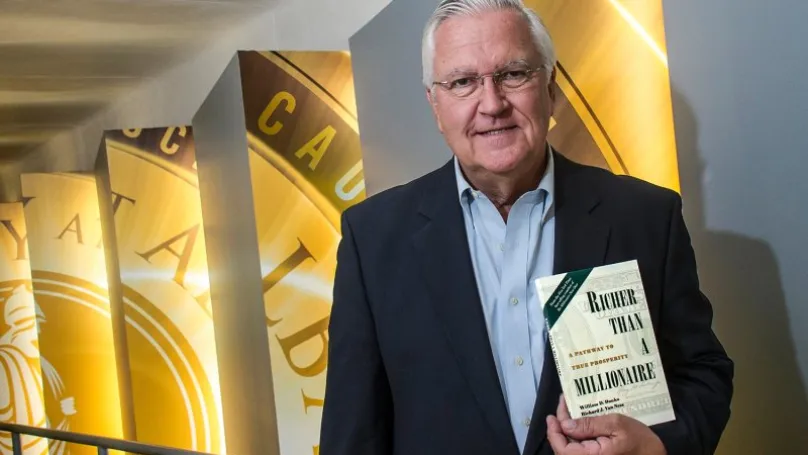

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

When we think about millionaires, flashy cars, grand mansions, and a showy life often come to mind. However, nothing can shatter such stereotypes as the groundbreaking book The Millionaire Next Door, a true manifesto written by Thomas J. Stanley and William D. Danko, who create a very compelling portrait of America’s affluent, more often than not unassuming, individuals who have acquired substantial wealth through discipline and good financial habits. This is a personal finance book published in 1996 that has ever since been required reading for people interested in managing their finances. The book is based on research that included interviews with thousands of millionaires. Among other things, Stanley and Danko researched common traits among millionaires.

Most people probably think that the majority of millionaires inherit their money or have very high-paying jobs; however, this is quite wrong. A frugal lifestyle, hard work, and self-discipline are some of the characteristics pinpointed by the authors of the research. Many respondents claimed to have lived below their means by saving or reinvesting a significant amount of their income.

Conclusion

Saving money is a process, not a point of arrival. Equipped with the right knowledge from the best books on saving money, you can implement effective strategies that put you in charge of your financial future. Remember, it’s never too late to save. Take ownership of the process, stay committed, and watch your financial garden flourish. Today can be the day to begin your journey to financial freedom!