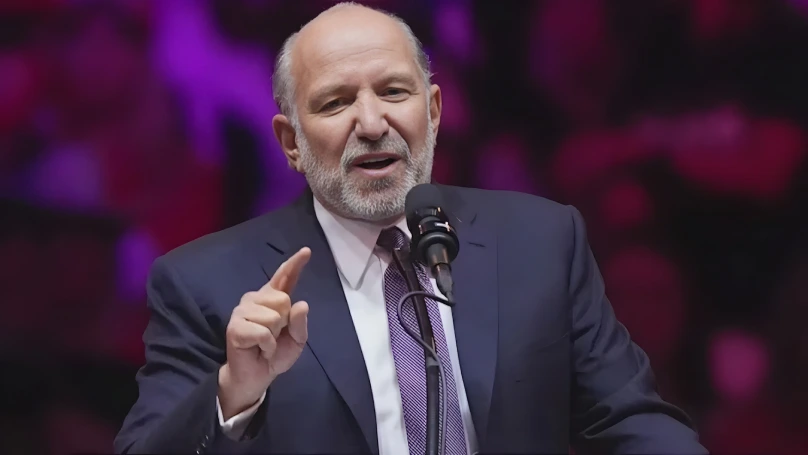

When it comes to the finance world, few figures have as heavy a name as Howard Lutnick. Whether it be his start with Cantor Fitzgerald, or his current job as U.S. Secretary of Commerce, Lutnick’s journey exemplifies perseverance, savvy dealing, and a tenacious spirit in the realm of rebuilding and innovation.

This article will review the multi-layered life of Howard Lutnick, his various sources of wealth, his role in the wake of 9/11, and how he transitioned into public service. We will share an account of the different sources of income that account for his estimated net worth of $2 billion in 2025, including roles with Cantor Fitzgerald, BGC Partners, Newmark Group, and other ventures into cryptocurrency and real estate, as well as his philanthropy and the controversies that have come to the public eye.

Early Life & Education

Howard William Lutnick was born July 14, 1961, in Jericho, Long Island, New York, to Solomon and Jane Lutnick. Solomon was a history professor at Queens College while Jane was a painter, sculptor, and lecturer at the C.W. Post Campus of Long Island University. Howard was raised in a Jewish family and was a middle child to Edie, a sister, and Gary, a brother.

Lutnick experienced tragedy early in life. During his junior year of high school, in 1978, his mother died of lymphoma. The next year, shortly after starting his freshman year at Haverford College in Pennsylvania, his father died of cancer. After that, he and his siblings were left largely on their own, with financial and emotional pressure.

Seeing early signs of his potential as well as the barriers in front of him, the president and dean of Haverford College provided Lutnick with a full scholarship for the remainder of his education. Such generosity was not something he could forget, and it sparked a strong sentiment of gratitude and the desire to pay it forward.

Lutnick performed well in school and he was also captain of the tennis team. He graduated in 1983 with a degree in economics, which would provide the groundwork for his subsequent career in finance.

Career Beginnings at Cantor Fitzgerald

In 1983, Howard Lutnick emerged from Haverford College and started his journey which would shape not only his professional career but also change Wall Street in various ways. He became an employee at Cantor Fitzgerald, an established bond trading firm, and quickly began to shine with his analytical ability and leadership skills. Within a year and a half, Lutnick was running a division for the firm doing the personal investments for B. Gerald Cantor, the firm’s founder, and a few of his partners. Lutnick had turned this into one of the firm’s most profitable divisions.

Then in 1991, at the age of just thirty, Lutnick was appointed President and CEO of Cantor Fitzgerald. Lutnick was faced with challenges, however. After the decline in health for Cantor, Lutnick was involved in very complex legal disputes over the firm’s successor and succession plan. Ultimately, however, Lutnick would become Chairman in 1996, and maintain leadership during a transitional phase.

With Lutnick at the helm, Cantor Fitzgerald seized opportunities in technology, most notably in developing new technology for eSpeed, which was their electronic trading platform launched in 1999 and made the firm the leader in electronic bond trading globally.

Surviving 9/11 and Rebuilding Cantor Fitzgerald

On Sept. 11, 2001, Howard Lutnick’s life changed forever. While his firm, Cantor Fitzgerald, occupied floors 101 to 105 of the North Tower of the World Trade Center, Howard was dropping his son off for his first day of kindergarten. For this seemingly innocuous act, he would lose his life, but nothing could compare to the loss he was about to suffer. In total, 658 of his colleagues died that day, along with his younger brother, Gary.

Going through the horrors of Sept 11 can be disastrous. Lutnick had the daunting task of honoring those who were lost and rebuilding his firm. In addition to publicly promising that he would donate 25% of Cantor Fitzgerald’s profits over the next five years to the victims’ families (approximately $180 million), he also promised that he would cover their health care for ten years.

Under his guidance, Cantor Fitzgerald both survived and thrived. The firm moved to Midtown Manhattan, grew its global footprint, and added new services. Lutnick showed uncommon resolve and dedication to convert a lose into a story of renewing hardship.

Today, Cantor Fitzgerald is a global financial juggernaut, a legacy to those who died, and a tribute to Lutnick’s steadfast resolve.

Major Revenue Streams

Howard Lutnick’s estimated $2 billion net worth in 2025 is based on a diverse combination of financial services and real estate investments. All of Lutnick’s wealth has its foundation in the leadership roles of Cantor Fitzgerald, BGC Group, and Newmark Group, as each provides income of a significant size.

Below is a table delineating the major sources of revenue contributing to Lutnick’s wealth:

| Company | Revenue Stream Description |

| Cantor Fitzgerald | Investment banking, prime brokerage, fixed-income trading, and cryptocurrency ventures. |

| BGC Group | Global brokerage services, including equities, fixed income, and real estate. |

| Newmark Group | Commercial real estate services, encompassing brokerage, advisory, and property management. |

| Cryptocurrency Ventures | Investments in digital assets, notably through partnerships with Tether and Bitfinex. |

| Philanthropic Initiatives | Revenue from annual charity events, such as the BGC Charity Day, supporting various global causes. |

These varied revenue sources highlight Lutnick’s strategic foresight and adaptability when faced with changing markets. Lutnick’s talent in moving quickly to change and seize opportunities in emerging areas, like the digital asset area, has allowed him to maintain and grow assets and wealth.

Cantor Fitzgerald: A Legacy of Resilience and Innovation

Cantor Fitzgerald a global financial services firm located in New York city, was founded in 1945. The firm focuses on investment banking, capital markets, and brokerage services for institutional clients world-wide. Cantor Fitzgerald is one of 24 primary dealers authorized to trade U.S. government securities with the Federal Reserve Bank of New York.

The company was severely impacted on September 11, 2001, with the loss of it’s North Tower headquarters as well as the loss of 658 employees. Under Howard Lutnick’s leadership, not only did Cantor Fitzgerald survive that day, but it also emerged as a more competitive and innovative force in the financial services industry.

BGC Group: A Global Brokerage Powerhouse

BGC Group, Inc. (previously known as BGC Partners) is a global leader in brokerage and financial technology, with headquarters in New York and London. BGC Group was created in 1945 and provides many services, including trade execution, broker-dealer services, clearing, processing, information, and other back-office services, etc. BGC Group provides access to over 200 financial products across all asset classes including fixed income, foreign exchange, equities, energy, and commodities for a diverse group of clients including institutional investors, banks, hedge funds, and corporations.

For the year 2024, the BGC Group had great financial results. They reported revenue of $572.3 million in Q4 which was an 11.8% growth year over year. Strong performances were recorded in multiple sectors including rates, foreign exchange, and energy commodities.

The firm also demonstrated its commitment to innovation with investments like the FMX Futures platform, it is also a new futures exchange for U.S. Treasuries and SOFR futures had the goal of competing directly with the CME Group.

Newmark Group: Transforming Commercial Real Estate

Newmark Group Inc. (NASDAQ: NMRK) is a leader in commercial real estate offering a full service platform with capital markets, leasing, property management, and valuation and advisory services headquartered in New York City and operating in over 170 locations globally.

Newmark had revenues of approximately $2.74B in 2024, which represented an approximate 10.85% increase over the same period, demonstrating Newmark’s continued strong performance across multiple service lines and a particularly strong year in capital markets and leasing.

Under the able leadership of Chairman Stephen Merkel and CEO Barry Gosin, Newmark has established itself as a leading commercial real estate business, consistently ranking among the top-tier firms in the industry, as measured against its peer firms. Newmark’s commitment to innovation and excellence supports Newmark’s continued success in an increasingly competitive marketplace.

Cryptocurrency Investments

In 2025, Cantor Fitzgerald launched a new Bitcoin venture of $3.6 billion in partnership with Tether, Bitfinex, and SoftBank with Brandon Lutnick serving as Chief Executive Officer, this venture, Twenty-One Capital, Tether invested $1.6 billion worth of Bitcoin, Bitfinex invested $600 million and SoftBank invested $900 million.

The plan was for Twenty-One Capital to be a leading Bitcoin-native public company focused on maximizing Bitcoin ownership per shareholder, by also being a convener in how to accelerate global Bitcoin adoption.

The venture represents more than just institutional cryptocurrency investment for Cantor Fitzgerald. The firm has acknowledged the new market environment and its responsibility to adapt and innovate organizationally towards Twenty-One Capital’s purpose while seeking to demonstrate credibility to institutional investors and exploring the unfolding convergence of traditional financial institutions and the cryptocurrency sector.

Philanthropy and Personal Life

Overall, Howard Lutnick’s life is one founded in resilience, compassion, and an unshakeable commitment to others. After September 11, when he lost 658 colleagues – including his brother, Gary, Lutnick emerged from that day standing for something. He catalyzed his loss to develop the Cantor Fitzgerald Relief Fund, which has successfully raised and distributed around $300 million to assist families impacted by terrorism, natural disasters, and other emergencies.

In addition to his selfless acts of philanthropy, Lutnick always conducted his personal life consistent with his values and ethics. Lutnick has been married to Allison Lambert since December 1994. Their family is blessed with four children, Brandon, Casey, Kyle, and Ryan. In 2025, in compliance with the government ethics rules, Lutnick transferred his ownership stake in Cantor Fitzgerald to his children, with Brandon becoming chairman.

Conclusion

Howard Lutnick’s path from tragedy to financial success embodies resilience and visionary leadership. As of 2025, his estimated net worth of $2 billion demonstrates, in addition to business talent, a strong commitment to rebuilding and innovating following the tragedy.

While his wealth is impressive, it is small compared to people like bill gates net worth 2025 is $107 billion and michael dell net worth 2025 is approximately $99.2 billion. However, Lutnick is measured not only by money but by the lives with whom he made an impact through philanthropy, as well as his record of resilience in rebuilding Cantor Fitzgerald after the tragedy of 9/11.

Lutnick had a personal tragedy to overcome to advance to philanthropy, which displays a life of turning suffering into a legacy. His example of life is to show that compassion and perseverance can be used to create a legacy larger than achieving personal goals.