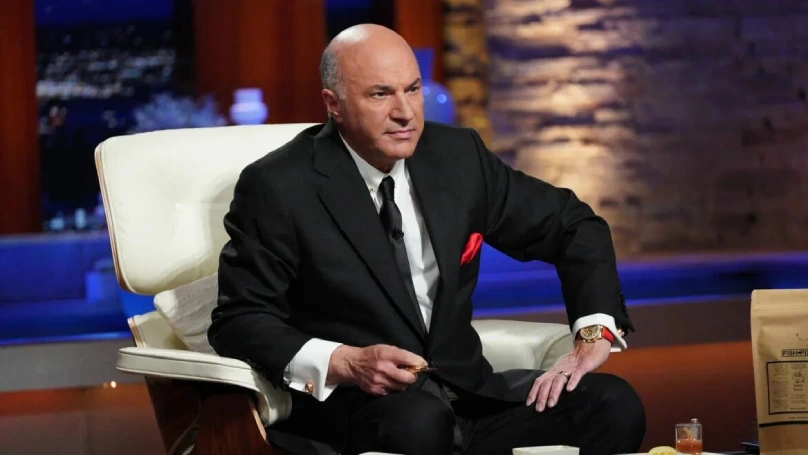

Kevin O’Leary is popularly referred to as “Mr. Wonderful,” but he is much more than an irascible figure on television screens. His net worth extends to $400 million by 2025, a towering symbol of ambition, risk taking, and unrelenting business savvy. But how did he get there? What drives the empire behind the man who built, sold, and reinvented companies from software to wine?

Born in Montreal, Canada, the biography of Kevin, from a very modest upbringing to global fame, reads almost like a fairy tale turned modern day adventure laced with a heavy dose of grit and negotiation skills. Early teachings from his mother the early saving and investing lessons set the stage for what would become a very diversified business empire. Not stumbled over, wealth engineered like a master architect.

Presently, O’Leary’s fortune is woven from successful exits like The Learning Company sale, shrewd investments on Shark Tank, consorted with real estate holdings, a flourishing wine brand, and even fintech innovations like Beanstox. A businessman, investor, TV personality, author, and speaker rolled into one dynamic person. Kevin O’Leary is many things today: businessman, investor, TV personality, author, and speaker.

With this article, we opened the net worth of Kevin O’Leary in 2025 the true stories, brilliant strategies, and bold moves behind the building of Mr. Wonderful empire.

Kevin O’Leary’s Net Worth in 2025

The various top sources estimate Kevin O’Leary’s net worth to be at roughly $400 million by the year 2025. Such wealth is the result of painstaking investments, running a business, and engaging in the media all years long.

The very first thing he did in 1986 was to start a company called SoftKey Software Products, which published highly educational software. Softkey pushed the envelope on aggressive marketing and acquisitions such that it soon led the pack in their industry. The Learning Company was acquired in 1995, after which the name was used in place of Softkey. Mattel took it back from The Learning Company four years later for $4.2 billion, although that acquisition later garnered a lot of criticism as a bad purchase.

In software and beyond, O’Leary’s investments diversified. He is one of the popular faces in the Shark Tank television series and has invested in many startups, having interests in different fields: technology, consumer goods, food services, etc. Companies such as Basepaws and BenjiLock are some of the notable investments.

Beyond television and investments, O’Leary is involved in other areas of business. He is the founder of O’Leary Fine Wines a prestigious wine label and O’Leary Ventures, a private equity venture capital investment firm. He is also significantly involved in the finance sector, being a co-founder of O’Leary Funds Inc., a global yield investing focused mutual fund company.

His entire approach toward investment revolves around diversifying and taking calculated risks. Also, he is into new markets such as cryptocurrencies, though some of these ventures, such as his backing of the now defunct FTX cryptocurrency exchange, have generated controversy.

As such, Kevin O’Leary’s net worth could be said to demonstrate a combination of his various activities from software development, television, ventures, and much more. He is a businessman who has survived a variety of market conditions set on entrepreneurial opportunities, making him wise in the ways of investment.

Kevin O’Leary’s Revenue Streams

| Revenue Stream | Description |

|---|---|

| Television Appearances | Earnings from shows like Shark Tank and Dragons’ Den |

| Venture Capital | Investments through O’Leary Ventures in various startups |

| Real Estate | Investments in residential and commercial properties |

| O’Leary Wines | Profits from his wine label |

| Beanstox | Revenue from his fintech app promoting automated investing |

| Speaking Engagements | Fees from public speaking and appearances |

| Book Sales | Income from his published books on business and finance |

| Endorsements | Earnings from brand endorsements and partnerships |

| Cryptocurrency Ventures | Investments and endorsements in the crypto space |

| Licensing Deals | Revenue from licensing his name and brand to various products and services |

Early Life and Education

Kevin O’Leary was born in Montreal, Quebec in 1954 and his formative years were comprised of the influences of both artistic and business pursuits. His mother was a great money manager and taught him the ropes of finance, while his stepfather had a photography business that fostered his entrepreneurial spirit. He obtained a bachelor of environmental studies and psychology from the University of Waterloo and an MBA from the Ivey Business School at the University of Western Ontario.

The Birth of SoftKey and The Learning Company

Kevin O’Leary started SoftKey Software Products in his Toronto basement in 1986 with a $10,000 loan from his mother. The business was focused mainly on educational software at that time, but it knew that by applying the principles of marketing consumer goods, it was doing something truly radical for the computer software industry. These principles included aggressive pricing, wide distribution, and marketing-focused packaging that attracted a mass audience to SoftKey products.

SoftKey thus sold products at extremely low prices and acquired other companies like WordStar International and Spinnaker Software to widen its product range. SoftKey’s acquisition of The Learning Company for $606 million, after which it inherited that name, solidified its position in the educational software arena. Under O’Leary’s continuing management, the company began to grow vigorously and was eventually purchased by Mattel in 1999 for $4.2 billion.

Aggressive marketing and expansion methods, O’Leary and his team succeeded in turfing SoftKey into the big-time income. O’Leary considered software consumer goods; thus, it created the greatest havoc in traditional software marketing obtained in distribution models and opened educational software up to the general public.

Television Ventures: Shark Tank and Beyond

Kevin O’Leary’s television career has, in many ways, contributed to the public persona that have contributed to his wealth. He came into the limelight with the Canadian show Dragons’ Den in 2006, where his harsh and unfiltered style earned him the nickname “Mr. Wonderful.” This character spilled over to the show’s American counterpart, Shark Tank, which he joined in 2009. Within Shark Tank, O’Leary has played a prominent role, offering analysis of proposed investments with a tough-love method; he prefers to see structured returns, which in his opinion should offer the investor some protection. Thus, his method of investing frequently sees him giving loans in exchange for royalties rather than equity stakes.

Ever since Shark Tank, O’Leary has been furthering his television profile. He was the co-presenter of Discovery Channel’s Project Earth a series about novel methods to solve environmental concerns. His on screen credit also includes being a regular contributor to many financial news programs like CNBC and BNN, providing insights on market movements and investment strategies.

Real Estate Investments

Kevin O’Leary, popularly acknowledged as “Mr. Wonderful,” has been deftly managing the expansion of his investment portfolio to embrace real estate, seeking niches offering the traditional return on investment and respect for the law of emergence.

Key Areas of Real Estate Investment

- Data Centers: O’Leary has shown a preference for data centers realizing that they are becoming more important in the digital world. He pointed to the intersection of real estate and technology and the emerging profitability of investing in data center space.

- Resorts: He also pointed to resorts being a great investment opportunity due to heavy demand and expected regular monthly return.

- Commercial Real Estate: He mentioned that he’s more cautious toward traditional commercial real estate, namely office space, because of changing work patterns and declining demand.

Investment Philosophy

The philosophy practiced by O’Leary in the realm of real estate investment is perhaps best expressed in the following manner:

- Cash Flow Focused: Cash-generating properties for guaranteed and regular income are of utmost importance.

- Flexibility: Shift investment focus according to the changing tides of market trends and newfound opportunities.

- Risk-averse: Proceed with caution in sectors exhibiting vulnerability and weakness.

Kevin O’Leary keeps asserting himself as a clever and futuristic investor, directing his real estate investments towards the sectors which have the promise of growth and stability.

O’Leary Wines: A Taste of Success

Launched in 2016, Kevin O’Leary’s introduction to the wine industry was the O’Leary Fine Wines brand, which quickly gained prominence for its quality and affordability. Partnering with Vintage Wine Estates, O’Leary sought to create wines meeting his rigorous standards without leaving consumers with excessive bills.

Linda O’Leary, wife to Kevin and one of the reasons for O’Leary Fine Wines’ success, is the Vice President of Marketing. Her great palate and marketing talents have helped to define the brand identity and image. Kevin usually praises Linda for her ability to analyze wines, especially her ability to taste and smell regional characteristics.

O’Leary Fine Wines has very wide-ranging book such as varietal offerings like Cabernet Sauvignon, Chardonnay, and Pinot Noir. It focuses on quality and value so that very fine wines are made available to a wider audience. This dovetails with Kevin O’Leary’s investment philosophy: brilliant products, cheap prices.

The success of O’Leary Fine Wine has elevated Kevin O’Leary to a new level of prowess in snatching market opportunities and executing effectively. By complementing his business acumen with Linda’s popular marketing prowess, the O’Learys have created a brand that appeals to wine enthusiasts and the casual consumer alike.

Beanstox: Democratizing Investment

Kevin O’Leary, or “Mr. Wonderful” as he is popularly known on Shark Tank, co-created the platform Beanstox to give average Joe investors an opportunity to invest concerning their own parameters. Launched in 2018, this automated investing application is dedicated to enabling wealth creation in people who may find the conventional mean of investing too complex or even intimidating.

Features for novice investors offered by Beanstox include:

- Automated ETF Portfolios: You can invest as an individual into asset chosen and allocated in a personalized and diversified manner between various ETFs that invest into U.S. dividend, growth, and tech stock.

- Low Minimum: The app allows even $20 as an alternative to investment, making it available to almost everyone.

- Beanstox can be cited as also possessing a very simple subscription model that charges $5 per month for its services without any hidden charges

- Educational resources: It gives out monthly information on markets, recaps, and finally, financial education that allows and empowers users to make informed decisions.

According to O’Leary, the principles of regular investing and diversification are critical to Beanstox. These principles are borne in technology and automation, which he hopes will allow everyone to confidently and easily take charge of their own financial destiny with Beanstox.

FTX Endorsement and Crypto Ventures

The journey of Kevin O’Leary into the world of cryptocurrencies has been one full of excitement and some amounts of controversy. From being very skeptical, O’Leary called it a “useless currency” back in 2019. Fast forward to 2021, O’Leary had changed his stance and invested in several cryptocurrencies and became a strategic investor in the decentralized finance platform WonderFi Technologies.

In August 2021, O’Leary also became the prominent paid spokesperson and ambassador for a major cryptocurrency exchange called FTX, in exchange for a huge $15 million compensation package that included an ownership stake in FTX’s parent companies.

Lessons from Mr. Wonderful

Kevin O’Leary, Mr. Wonderful, believes in speaking frankly and giving real financial advice. He has various experiences in different sectors. His learning from these experiences invariably becomes the lessons he imparts to aspiring entrepreneurs or investors.

A quote from O’Leary captures his whole belief about investment:

“I want to invest in companies that are going to be around forever.”

In these words, he would prefer the sustainable models of businesses and their long-term viability. Consistent value in such companies that can hold the ups and downs of market fluctuations occurs to him.

Conclusion

His upscaled basement startup has helped him move from that lagoon to an approximate net worth of $400 million by the year 2025. This is diversified across several strategic extensions, coupled with very good investment decisions. His strongholds include educational software, television, real estate, and fintech; all of which contribute towards his monetary success. With an ability to keep up with market trends and with efforts toward financial literacy, O’Leary has solidified his stature as a smart entrepreneur and investor.

Another important aspect here is for finance enthusiasts who would like to learn more about the great money lives of other big names. Amongst many of our comprehensive articles shall include that of Tony Robbins net worth and andrew tate net worth 2025.

The message of O’Leary is an encouraging static spark for emerging entrepreneurs: with change, perseverance, and some clever plotting, all-expansive success is within reach.